Private equity

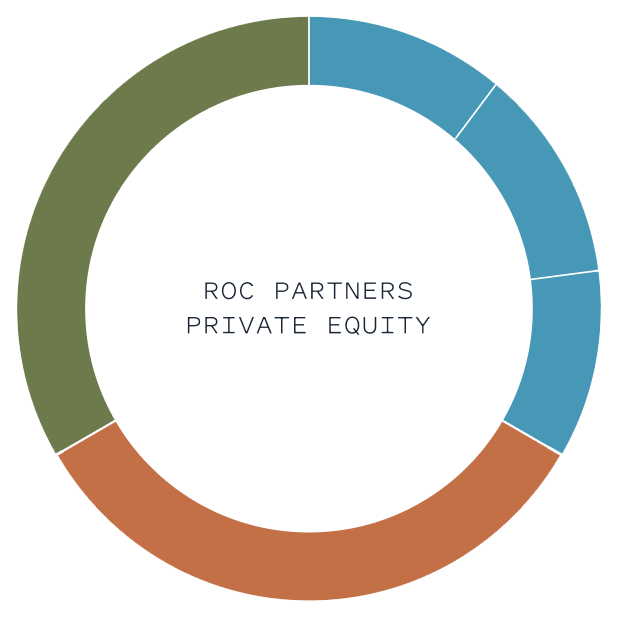

We have over 25 years’ experience investing in Asia-Pacific private equity, deploying over AU$7.0 billion across more than 400 investments in funds, secondaries, co-investments and direct investments. Our investments are made through commingled funds targeting specific strategies and separately managed accounts for larger clients interested in a more bespoke program.

Multi-strategy

Fund investments

We have been investing in leading funds in the Asia-Pacific region for over 25 years. Viewed as a trusted partner and capital allocator of choice, we have a high-conviction, systematic approach to primary fund investments. We have made more than 150 fund commitments across buyout, growth capital and special situation strategies.

Secondaries

We have been an active provider of liquidity solutions to other private equity investors for more than 15 years. With a wide network and primary market coverage, we know the Asia-Pacific market intimately. We make discrete, timely and competitive offers to those seeking liquidity for private equity interests, be they partnership interests, special purpose vehicles, or direct stakes in private companies.

Co-Investments

We have been investing alongside our preferred funds for over 25 years. Our relationships provide access to highly coveted co-investment deal flow and our expertise and structured investment process allow us to move decisively. Our team has invested over AU$1.0 billion in more than 70 co-investments across the Asia-Pacific region.

Growth equity

We have built our direct growth equity strategy based on over 20 years’ experience of successful private equity investing in Australia. We have invested across a broad range of industries including healthcare, environmental services, education, telecommunications, food and beverage, IT and business services.

Food and agriculture

We have been investing in food and agribusiness for more than 15 years. We take a private equity approach by investing across the value chain in businesses with proven management teams, high barriers to entry, clear growth opportunities and sustainable long-term business models.

Fund investments

We have been investing in leading funds in the Asia-Pacific region for over 25 years. Viewed as a trusted partner and capital allocator of choice, we have a high-conviction, systematic approach to primary fund investments. We have made more than 150 fund commitments across buyout, growth capital and special situation strategies.

Secondaries

We have been an active provider of liquidity solutions to other private equity investors for more than 15 years. With a wide network and primary market coverage, we know the Asia-Pacific market intimately. We make discrete, timely and competitive offers to those seeking liquidity for private equity interests, be they partnership interests, special purpose vehicles, or direct stakes in private companies.

Co-Investments

We have been investing alongside our preferred funds for over 25 years. Our relationships provide access to highly coveted co-investment deal flow and our expertise and structured investment process allow us to move decisively. Our team has invested over AU$1.0 billion in more than 70 co-investments across the Asia-Pacific region.

Food and agriculture

We have been investing in food and agribusiness for more than 15 years. We take a private equity approach by investing across the value chain in businesses with proven management teams, high barriers to entry, clear growth opportunities and sustainable long-term business models.

Growth equity

We have built our direct growth equity strategy based on over 20 years’ experience of successful private equity investing in Australia. We have invested across a broad range of industries including healthcare, environmental services, education, telecommunications, food and beverage, IT and business services.

MARKET OUTLOOK

Capital commitment through market cycles

Following a downturn in markets, we discuss Roc Partners’ outlook for the deployment of capital in direct private equity as well as the opportunity set within different segments of the Australian market.

CONTACT US

If you’re a sophisticated investor, a business seeking capital or a business adviser with an opportunity you would like to discuss, please contact our team today. For business owners seeking capital please also include a brief description including the company name and turnover.