Responsible investing

At Roc Partners, we believe responsible and sustainable investing is a global business imperative and is key to building long-term value in a rapidly changing and increasingly complex world. We approach everything we do with a long-term mindset.

responSible investing framework

Our framework for responsible investing aligns to our long-term mindset and has been developed to evolve over time as the market, and global priorities shift. Contact us to obtain a copy of our Responsible Investing policy.

Our commitment to responsible investing and value creation is incorporated into all that we do.

An unwavering focus on improving social and environmental outcomes alongside superior financial results.

Continued adoption of leading frameworks and standards to measure, disclose and report progress and drive best practices.

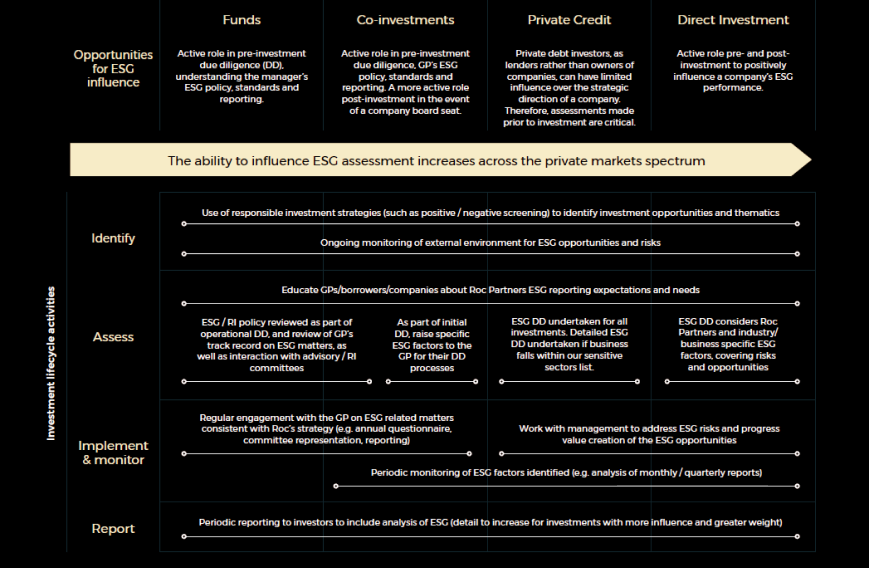

ESG integration across investment strategies

Different investment strategies require different approaches to ESG incorporation. We take an active approach to integrating ESG throughout the investment lifecycle for each of our investment strategies.

Our partners and initiatives

Our approach to responsible investing is underpinned by initiatives and key performance indicators that track outcomes through formal reporting.

Responsible Investing report

Roc Partners is committed to disclosing ESG and Responsible Investment progress appropriately. We recognise that this is a continuous journey and it is one that we are taking seriously. Our 2023 financial year report highlights our continued focus on integrating responsible investing across our investment lifecycle and business operations.

Related Content

CONTACT US

If you’re a sophisticated investor, a business seeking capital or a business adviser with an opportunity you would like to discuss, please contact our team today. For business owners seeking capital please also include a brief description including the company name and turnover.