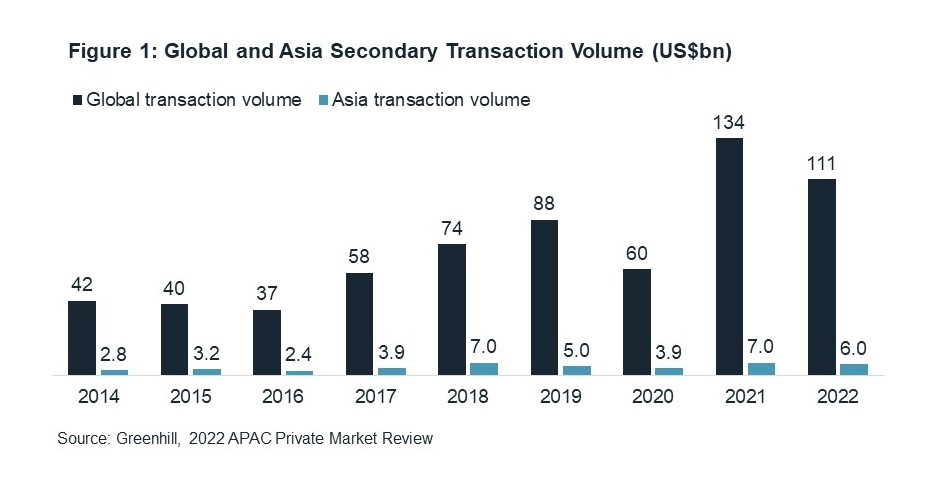

A brief history. Globally, the secondaries market is relatively mature. With global deal volume estimated at $111bn in 2022 (Figure 1) it has been one of the fastest growing strategies within private equity. In Asia, the secondary market started to emerge meaningfully in the late 2000s in the aftermath of the Global Financial Crisis (GFC). Transactions during this period were driven by distress, changes in regulation to meet capital adequacy and solvency requirements, or due to changes to strategy and personnel, as well as the spinout of teams and assets from banks, corporate private equity and venture capital arms, and local team and asset departures from several global funds. Since its emergence, the secondary market in Asia has kept pace with the global secondary market, representing 5-10% of global volumes which is comparable to the proportion Asia has represented in global primary capital raised. With aggregate exit values declining sharply in Asia in 2022, secondaries represented 22% of the total private equity exit volume within the region, a sign of its growing importance as a channel for liquidity2.

Many reasons to trade. The secondaries market has matured over time due to a growing acceptance of selling by investors as part of regular portfolio management. Rather than holding to maturity, which can take 10-15 years for fund commitments, some investors have sold early. Reasons for this have included the cleaning up of tail-end portfolios, the rationalisation of manager relationships, and the generation of liquidity for redeployment elsewhere.

Related to this, for some Limited Partners (LPs), the reason for selling their stake can often be unrelated to the performance of their investments. For example, recently, during the first wave of global COVID-19 lockdowns, some smaller endowments sought to generate liquidity due to concerns over the potential impact travel restrictions would have on their tuition income, and in Australia, fee reduction has been a reason in recent years for encouraging some superannuation funds to sell.

General Partners (“GPs”) have also turned to secondary market. While some GPs have also sought to hold onto their “winners”, many funds in China for example have lost years to on and off again lockdowns, which have severely elongated value creation and exit plans while liquidity demands have been building up as their funds approach maturity. Such factors have resulted in an uptick in the volume of GP-led secondaries, which involve the restructuring of interests held by a fund to provide existing LPs a liquidity option with the incumbent GP remaining involved in managing the assets rather than selling those company stakes to external buyers. These LP replacement models have been well developed in U.S. and European markets over the past decade with the know-how being brought to Asia and providing another useful liquidity channel in recent years, particularly in the absence of others.

Over the last 15 years, the multitude of reasons to trade, mentioned above, have propelled the secondaries market in Asia and we expect these trends to continue.

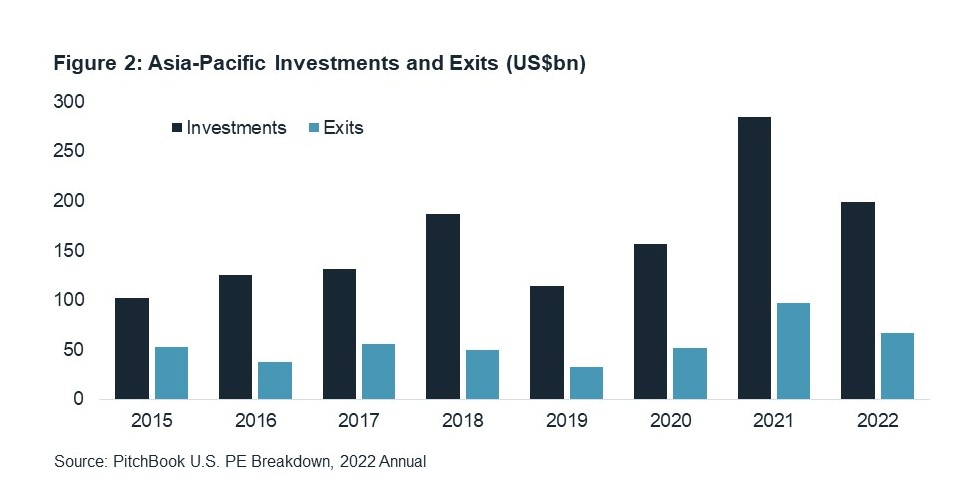

Growing exit demands. Overall, recent exit activity in Asia has lagged that of the U.S. and Europe. According to the Asia Private Equity Review (APER), distributions in Asia in 2022 were down 31% from the prior year, and since 2015, the ratio of distributions to contributions was only 33%; this compares to U.S. data which achieved a ratio of 56% over the same period, according to the 2022 Annual PitchBook U.S. PE Breakdown. As public equity market conditions for new company listings have weakened, and there has been a substantial increase in the cost of money in the last 12 months, this has caused material changes in attitudes towards liquidity and risk. As such, both LPs and GPs alike are seeing value in secondary market liquidity.

As it has been common for investors to sell out of assets that are furthest away from home, with foreign capital representing a substantial source of funding for Asian assets in the past, the selling pressure has been building.

In 2022, US$6bn of secondary transactions were completed and it is projected that under the right conditions the secondary market could reach US$13-16bn per annum, from 2023 to 2025, 2-3x the 2022 total1.

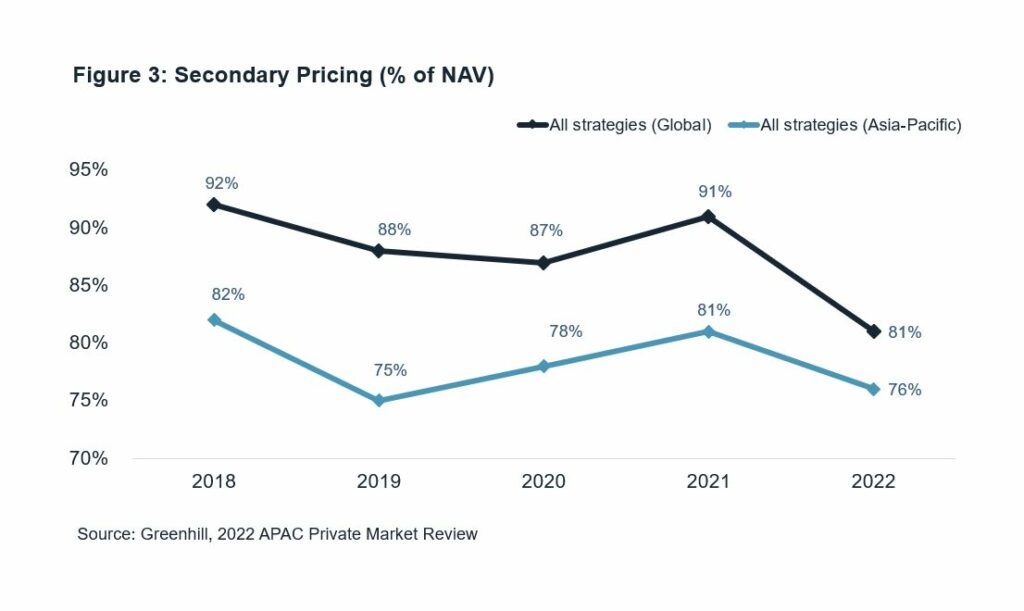

An opportunity. In our view, there is no time in history that the private equity secondary market in Asia has been more relevant and opportune, with data further pointing to a decline in secondary pricing levels as a percentage of net asset values (NAV) (see Figure 3). That said, it is not just about the “discount”. Secondary investing in Asia presents similar considerations as other forms of investing across the region, where country, geopolitical, macro-economic, industry and capital market considerations need to be weighed up against the nuances of the situations, assets and the people involved.

For those who are able to navigate the complexities of the region, the return premium can be meaningful. For skilled local practitioners, it is an opportune time.

About us

Roc Partners is a specialist private markets investment firm with over 65 employees across four offices located in Sydney, Melbourne, Hong Kong and Shanghai. For over 25 years, we have managed and advised clients on private markets investments across private equity, real assets and private credit. Today, with over A$8bn in funds under management or advice (as of 31 March 2023), we have one of the largest and most experienced private markets investment teams in the Asia-Pacific region.

Our private equity capabilities include primary, secondary, co-investment and direct investments with specialist teams for growth equity and direct food and agriculture investments. The business has been in operation since 1996, Roc Partners became a majority employee-owned firm in 2014 through a management buyout of Macquarie Group’s private markets business unit (“MIMPM”) by its senior executives.

Roc Partners holds an Australian Financial Services Licence as Roc Capital Pty Limited ACN 167 585 764 (AFSL No. 460464) and is regulated under the Australian Corporations Act 2001 (Cth) to provide general product advice to “wholesale clients”.

- Greenhill, 2022 APAC Private Market Review

- Bain & Company, Asia-Pacific Private Equity Report 2023, https://www.bain.com/insights/asia-pacific-private-equity-report-2023/