Quarterly Insights: Q3, 2022

Private markets globally are at an all-time high, with US$10 trillion in assets now invested in the sector, representing a five-fold increase since 2007.1

Within private markets, private credit has shown considerable growth over recent years. The Australian private debt market reached $133 billion at the end of 2021, up by $100 billion over five years.

The expansion of private credit markets has been fuelled by a harsher regulatory environment for banks, both locally and globally, in the years following the global financial crisis. As banks tightened their lending criteria in response to tougher regulations, business borrowers sought alternative sources of funding. This created opportunities for private investors to offer financing options tailored to borrowers’ needs, with terms and conditions favourable to delivering attractive risk-adjusted return to the investor.

Now, with inflation and interest rates rising – to the detriment of returns on traditional fixed income securities, but to the benefit of segments of the private credit market – investors are likely to increasingly seek out opportunities in private credit.

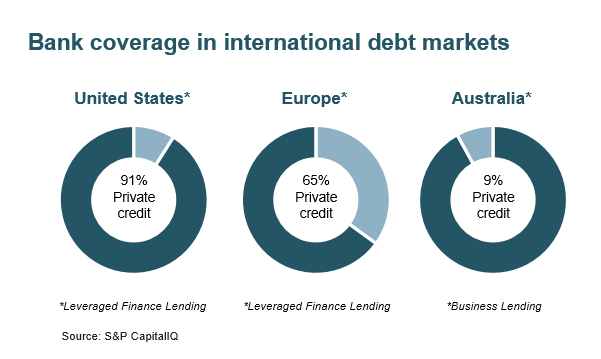

Even following its recent expansion, the Australian private credit market is still in its infancy. Trends overseas suggest the market here in Australia has the potential for ongoing growth in the short to medium term.

Why private credit?

While private credit is growing, the asset class is not widely understood by investors. Simply put, private credit is non-bank lending provided to private, sponsored and public companies; the debt is not issued or traded on public markets and as such benefits from an illiquidity risk premium, which can help to drive investor returns.

Private credit offers several potential advantages. For instance, it can:

- Generate a consistent income stream underpinned by the contractual obligation of interest payments between borrower and lender;

- Provide exposure to a market that has historically been difficult to access;

- Deliver a low correlation with equities and related asset classes;

- Provide access to the lowest risk part of the capital structure, where – as a senior secured lender – the investor can benefit from terms and conditions such as security and covenants;

- Offer defensive protection from inflation if cash rates are increased, given their typically floating rate nature.

Another feature of private credit investment that may benefit investors is that it is possible to be highly selective in investment decision making, with the ability to select assets from a wide funnel of private transactions and choose the best ones for their fund. For example, the Roc Private Credit Fund was established specifically to identify and take up private credit opportunities in businesses in Australia and New Zealand that have a proven track record in delivering consistent returns and are considered to have strong risk-adjusted investment prospects.

Transactions are negotiated between the borrower and lender and include numerous protections to the lender such as security, covenants and other terms and conditions that make private credit more defensive than other forms of investments.

An inflationary environment

After more than a decade of low inflation, the major global trend in 2022 to date has the been the return of inflation. The cash rate, which increased to 2.35 per cent in September, is now at its highest level since December 2014 and is poised to increase further as the Reserve Bank of Australia (RBA) seeks to lower inflation, which is forecast to hit 7.8 per cent by the end of 2022.2

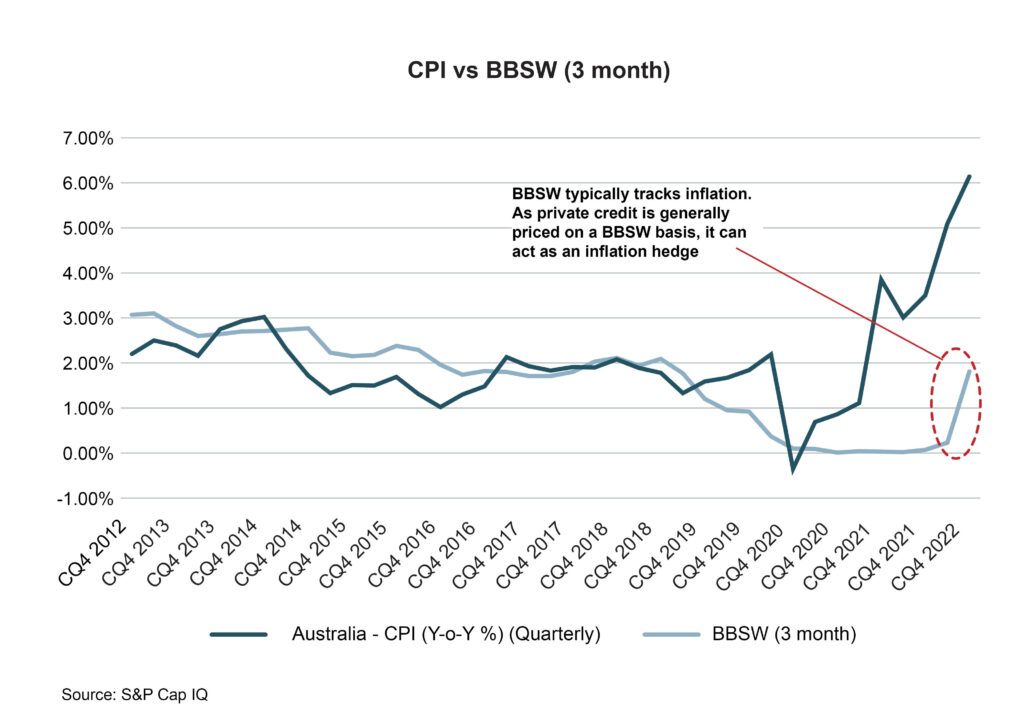

Rising cash rates are pushing up the Bank Bill Swap Rate (BBSW), which is the benchmark rate for pricing much of the Australian dollar debt market, including corporate debt.

The three-month BBSW is now at its highest level since 2015 – above 2.6 per cent – having increased from below 0.1 per cent at the start of 2022. Markets are pricing in the high likelihood of continued rate rises into 2023 as illustrated by the rising yield curve for long-dated swaps, which reflect the market’s anticipation of BBSW at certain points in the future. The current one-year BBSW swap rate – which is essentially the market’s expectation of where BBSW will be in one year’s time – is at 3.3 per cent, having been near zero 12 months ago.3

As the below chart shows, interest rates are not anticipated to come down anytime soon.

Hedge against inflation

Private credit provides a potential hedge against inflation as corporate loans are generally priced on a floating rate (being BBSW) basis. This pricing method means that any interest rate increases made in response to rising inflation are passed on to borrowers at the beginning of each interest rate roll period, which are typically for a tenor of between 30 and 180 days. This differentiates private credit from other asset classes, such as fixed income and equities, which typically have an inverse relationship with interest rates.

Private credit vs fixed income

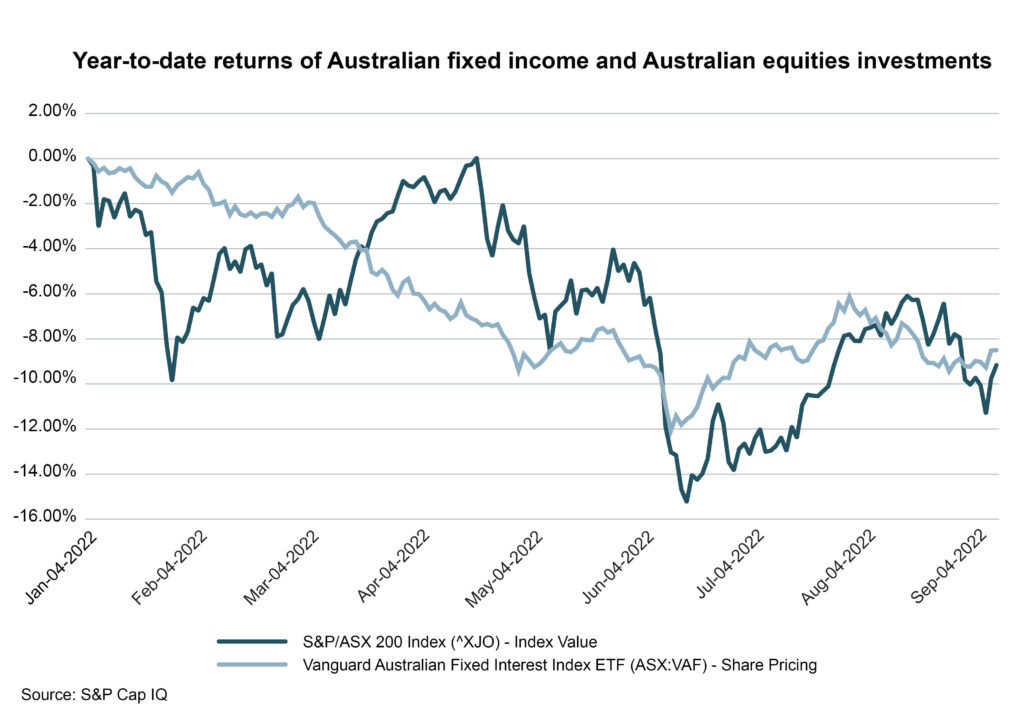

In a rising interest rate environment, private credit is well positioned to outperform traditional fixed income investments.

Australian fixed income investments are down 8.5 per cent since the start of the year. This performance is similar to that of equities, as the chart below illustrates. The traditional benchmark portfolio comprising of 60 per cent equities, 40 per cent bonds has had a particularly bad start to the year as a result.

Given the inverse relationship between interest rates and bond prices, as rates continue to climb the price of bonds will continue to fall, and investors will face further capital losses on their fixed income investments. In addition, as rates continue to climb, fixed income investors may struggle to earn a satisfactory yield relative to other investment opportunities in the market.

In contrast, private credit benefits from increasing rates since rate rises are passed through to borrowers, as mentioned above. Private credit is also less volatile than fixed interest investments, as it is not traded on public markets and therefore generally not subject to mark-to-market pricing.

Private credit vs bank hybrids

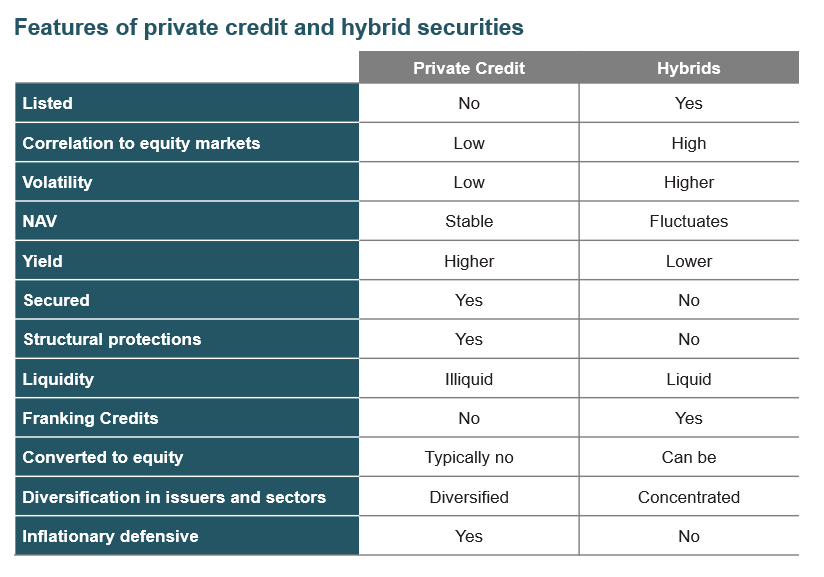

Over the past decade, which has been characterised by low interest rates with term deposit rates stuck near zero, hybrid investment options have become popular with investors seeking an alternative to fixed income investments. Investors are attracted to bank hybrids by the regular distribution payments and high return profile. Recently, hybrids have typically paid a yield of around 5-7 per cent per annum, not dissimilar to private credit which had targeted yield of 5-10 per cent per annum, depending on the nature of the fund and the risk of the investment strategy.

So, what differentiates these two asset classes?

Hybrids are securities that have features of both debt and equity. They are like debt because they pay regular income and have a notional term (although they can potentially be perpetual), and there is no upside or potential for capital gain over the original investment amount. Like private credit, distributions are typically priced at a fixed margin over the bank bill swap rate (BBSW), although these are adjusted for franking. Therefore, like debt, hybrids can be rewarding to investors in a rising rate environment.

That said, hybrids also have characteristics of equity in that they are classified as ‘capital’ by the issuer, repayment of capital is not secured, and they trade on the Australian Securities Exchange (ASX) similar to a share. Furthermore, hybrid distribution payments can be deferred for several months, or even years, if the issuing bank is experiencing financial difficulty. Missed payments are non-cumulative, meaning if they miss a distribution, they do not have to make this up in the future. The issuing bank can also, at its own discretion, convert hybrid securities into shares.

These equity-like attributes are the key differentiator between hybrids and private credit. Both investments provide a hedge to inflation in a rising interest rate environment and pay similar returns; however, unlike hybrids, private credit is ‘secured’ and sits above equity and unsecured creditors in a firm’s capital structure, lowering the probability of capital loss.

Private credit also offers greater certainty over distribution payments (i.e. interest), which are a contractual obligation between the borrower and the lender in a private debt investment.

In a private credit fund, investors benefit from diversification of the underlying issuers that comprise the fund. This is in contrast to hybrids which are concentrated on the credit quality of the one issuer and are unsecured and rank alongside other creditors. Consequently, hybrid capital does not enjoy the same capital protection as being invested in a secured credit security.

So why is it that both investments pay a similar return, despite having different rankings in the capital structure of a company? In general, the answer is liquidity.

While hybrids are highly liquid and can be traded on the ASX, private credit is not issued or traded on public markets. The underlying loans that make up a private debt fund typically have a tenor of around five years and therefore private credit strategies are usually illiquid. As a result, investors demand a higher yield (or illiquidity premium) to compensate for that risk.

In summary, private credit provides an attractive risk-adjusted return, benefiting from a superior position in the capital structure of a company when compared to hybrids, although they are less liquid.

Opportunities in private credit

As mentioned above, the Australian private debt market has grown from $33 billion in 2016 to $133 billion at the end of 2021. The tightening regulatory environment for local and global banks post-GFC, and the interest of investors in gaining access to a new asset class are key drivers of this growth

Although Australia was not directly affected by the sub-prime crisis, the GFC triggered massive shocks to international capital markets. These shocks spilled over and began to impact local markets and banks, which lost access to wholesale financing, leading to an increase in the cost of funding.

Post-GFC, regulators forced banks to review their balance sheets, increasing their capital requirements. This change saw banks take a more conservative approach to origination and direct lending (particularly cash flow lending). In addition, the more capitalised balance sheets have lowered banks’ returns on equity, making it more difficult for them to price competitively, particularly in certain lending segments that lack real asset security such as corporate loans and leveraged buyouts.

In addition, banks have become more selective in terms of types of borrowers, preferring to lend to larger companies and businesses rather than smaller and mid-sized enterprises.

As a result of these funding challenges, private credit started to gain traction in the post-GFC Australian debt market. This growth has accelerated in recent years as banks have continued to pull away from certain market segments. In Australia, most companies are still unrated – an important prerequisite to accessing public debt markets – and as such have historically lacked meaningful alternatives to the private financings provided by the banks.

From a borrower’s perspective, the rise of private credit has introduced a wider range of financing options, with greater flexibility in terms and an improved ability to meet the bespoke needs of borrowers.

Despite nearly doubling in the past five years, the Australia private credit market is still relatively immature when compared to the US and European markets, as highlighted below. Given the Australian market typically follows structural changes in overseas markets (albeit with a lag), this indicates ample potential for private credit to continue to grow in the short to medium term.

Favourable terms in Australia

The Australian senior secured debt market still benefits from robust terms and conditions, in contrast to markets in the US and Europe which have seen a deterioration in the quality of terms and conditions.

Outside of Term Loan B transactions, the Australian Leveraged Buyout (LBO) market typically benefits from one to two maintenance covenants, integrity around definition of EBITDA, and restrictions around the borrower’s use of cash – such as their ability to pay dividends, make acquisitions and dispose of assets.

In the US and Europe, 80 per cent of leveraged loan issuances are ‘covenant-lite’, meaning they typically only include a covenant in favour of working capital providers, rather than maintenance covenants to the benefit of all lenders. LBOs in the US and Europe are also often initiated at a higher leverage, increasing the risk to borrowers and lenders alike.

The legal backdrop is also more favourable in the Australian market than in overseas markets. Australian insolvency laws are creditor friendly. In an event of default, an enforcement/insolvency processes can be undertaken without court involvement or judgement, speeding up the road to resolution. In addition, secured creditors can appoint their own receiver to complete the winding up. This is uncommon in international markets.

In conclusion

The market for private credit is expanding and is expected to continue on its growth trajectory in the short to medium term.

With a growing opportunity set, private credit can offer investors the potential for attractive risk-adjusted returns in an inflationary and rising interest environment, with the benefit of a favourable position in a company’s capital structure.

Private credit investments are relatively illiquid and manager skill and experience is needed to access deals and select transactions that will deliver the best outcomes for their funds.

About Roc Partners’ private credit capability

Roc Partners has been investing in private markets across the Asia Pacific region since 1996. The firm has raised successive private equity primary investment, secondary investment and co-investment funds and consistently deployed capital in the region over the past 25 years. The Roc Partners Credit Fund builds on the firm’s extensive experience in investing in private markets. With the support of our institutional and sophisticated investors over the years, Roc Partners has developed unrivalled access to some of the most successful private market investment firms in the Asia Pacific region, many of whom Roc Partners has supported since their first fund. These long-term, trusted relationships provide Roc Partners with access to highly coveted deal flow.

Learn more about our proven capabilities in private credit investment.

- Preqin

- https://www.abc.net.au/news/2022-07-28/treasurer-warns-economic-outlook-worsening-inflation-to-rise/101276550

- NAB Markets Update, 12 September 2022.